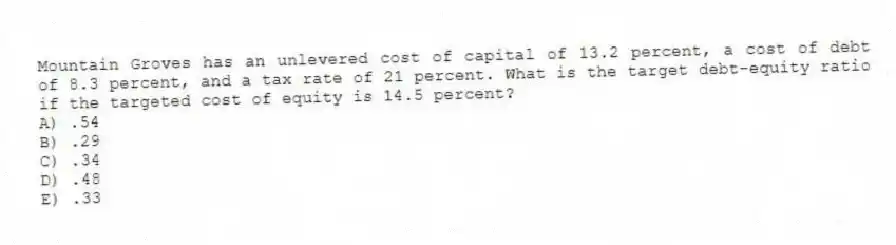

Mountain Groves has an unlevered cost of capital of 13.2 percent, a cost of debt of 8.3 percent, and a tax rate of 21 percent. What is the target debt-equity ratio if the targeted cost of equity is 14.5 percent?

A) .54

B) .29

C) .34

D) .48

E) .33

Correct Answer:

Verified

Q62: The Book Worm is an unlevered company

Q63: The Jean Outlet is an all-equity firm

Q64: ABC and XYZ are identical firms in

Q65: Ignoring taxes, Pewter & Glass has a

Q66: Lester's has expected earnings before interest and

Q68: An unlevered company has a cost of

Q69: Lamey Co. has an unlevered cost of

Q70: Roy's Welding has a cost of equity

Q71: L.A. Clothing has expected earnings before interest

Q72: Key Motors has a cost of equity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents