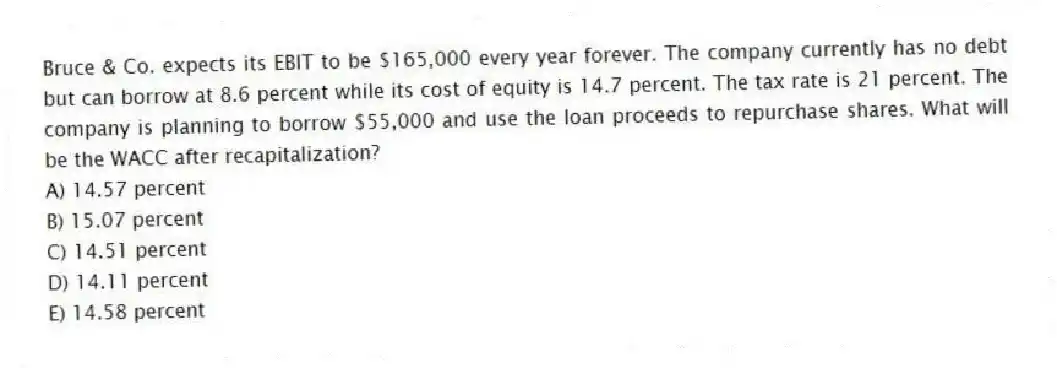

Bruce & Co. expects its EBIT to be $165,000 every year forever. The company currently has no debt but can borrow at 8.6 percent while its cost of equity is 14.7 percent. The tax rate is 21 percent. The company is planning to borrow $55,000 and use the loan proceeds to repurchase shares. What will be the WACC after recapitalization?

A) 14.57 percent

B) 15.07 percent

C) 14.51 percent

D) 14.11 percent

E) 14.58 percent

Correct Answer:

Verified

Q82: New Schools is an all-equity company with

Q83: LP Gas has a cost of equity

Q84: Home Decor has a debt-equity ratio of

Q85: The June Bug has a $565,000 bond

Q86: Douglass & Frank has a debt-equity ratio

Q88: KN&J expects its EBIT to be $147,000

Q89: Georga's Restaurants has 7,000 bonds outstanding with

Q90: KN Stitches has debt of $26,000, a

Q91: Auto Care has a pretax cost of

Q92: Jamison's has expected earnings before interest and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents