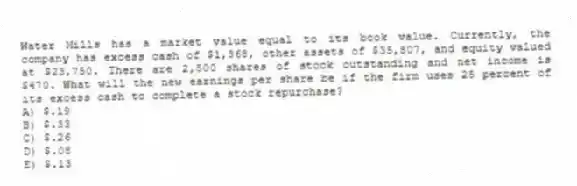

Water Mills has a market value equal to its book value. Currently, the company has excess cash of $1,368, other assets of $35,807, and equity valued at $23,750. There are 2,500 shares of stock outstanding and net income is $470. What will the new earnings per share be if the firm uses 25 percent of its excess cash to complete a stock repurchase?

A) $.19

B) $.33

C) $.26

D) $.08

E) $.13

Correct Answer:

Verified

Q74: Randall's has 34,000 shares of stock outstanding

Q75: Tucker's National Distributing has a current market

Q76: Verbal Communications has 18,400 shares of stock

Q77: Delaware Trust has 2,400 shares of common

Q78: You own 400 shares of stock in

Q80: The equity of Blooming Roses has a

Q81: City Center Pharmacy has 24,500 shares of

Q82: East Coast Marina has 65,000 shares of

Q83: The market value balance sheet for MZ

Q84: Purvis Lawn Products has 5,400 shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents