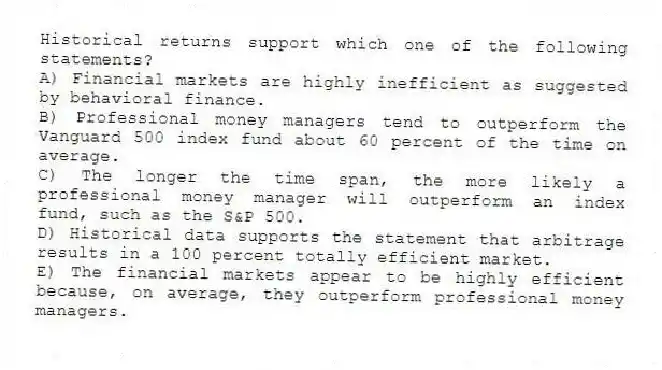

Historical returns support which one of the following statements?

A) Financial markets are highly inefficient as suggested by behavioral finance.

B) Professional money managers tend to outperform the Vanguard 500 index fund about 60 percent of the time on average.

C) The longer the time span, the more likely a professional money manager will outperform an index fund, such as the S&P 500.

D) Historical data supports the statement that arbitrage results in a 100 percent totally efficient market.

E) The financial markets appear to be highly efficient because, on average, they outperform professional money managers.

Correct Answer:

Verified

Q38: You are a hard-charging manager who doesn't

Q39: The last two promotions within a firm

Q40: Which word best describes the stock market

Q41: Which one of these statements related to

Q42: Which one of the following statements is

Q43: Which one of the following statements related

Q45: Following the Crash of 1929, the stock

Q46: Which one of the following statements is

Q47: Approximately what percent of its total value

Q48: Which one of the following is given

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents