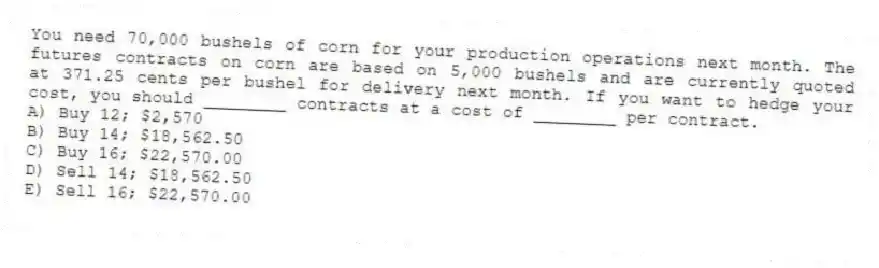

You need 70,000 bushels of corn for your production operations next month. The futures contracts on corn are based on 5,000 bushels and are currently quoted at 371.25 cents per bushel for delivery next month. If you want to hedge your cost, you should ________ contracts at a cost of ________ per contract.

A) Buy 12; $2,570

B) Buy 14; $18,562.50

C) Buy 16; $22,570.00

D) Sell 14; $18,562.50

E) Sell 16; $22,570.00

Correct Answer:

Verified

Q59: In any one year, the chance that

Q60: Which one of the following actions obligates

Q61: Futures contracts on gold are based on

Q62: Suppose an investor buys a call option

Q63: You decided to speculate in the market

Q64: You expect to deliver 50,000 bushels of

Q65: You anticipate your firm will need 20,000

Q66: Suppose you sold three September cocoa futures

Q67: Suppose that last month you purchased ten

Q69: Suppose a novice investor buys a call

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents