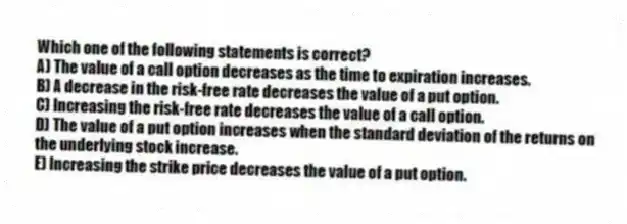

Which one of the following statements is correct?

A) The value of a call option decreases as the time to expiration increases.

B) A decrease in the risk-free rate decreases the value of a put option.

C) Increasing the risk-free rate decreases the value of a call option.

D) The value of a put option increases when the standard deviation of the returns on the underlying stock increase.

E) Increasing the strike price decreases the value of a put option.

Correct Answer:

Verified

Q20: The primary purpose of a protective put

Q21: The value of an option is equal

Q22: The value of a call option delta

Q23: Paying off a firm's debt is comparable

Q24: The implied standard deviation used in the

Q26: A firm has assets of $16.4 million

Q27: The estimate of the future volatility of

Q28: Purely financial mergers:

A) are beneficial to stockholders.

B)

Q29: The value of the risky debt of

Q30: Which one of the five factors included

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents