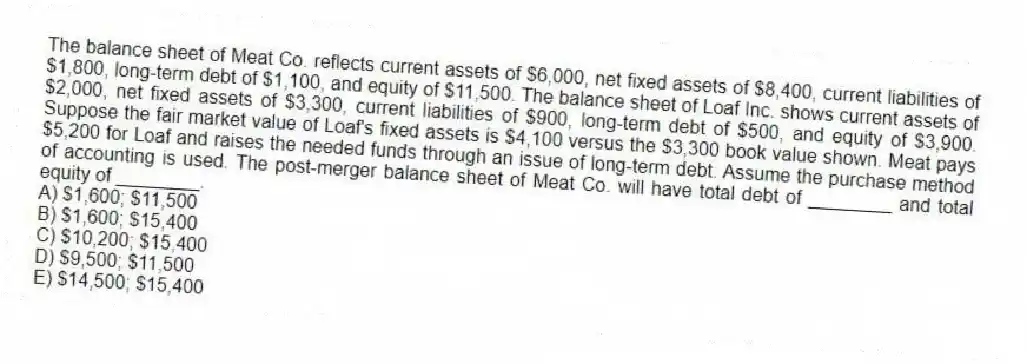

The balance sheet of Meat Co. reflects current assets of $6,000, net fixed assets of $8,400, current liabilities of $1,800, long-term debt of $1,100, and equity of $11,500. The balance sheet of Loaf Inc. shows current assets of $2,000, net fixed assets of $3,300, current liabilities of $900, long-term debt of $500, and equity of $3,900. Suppose the fair market value of Loaf's fixed assets is $4,100 versus the $3,300 book value shown. Meat pays $5,200 for Loaf and raises the needed funds through an issue of long-term debt. Assume the purchase method of accounting is used. The post-merger balance sheet of Meat Co. will have total debt of ________ and total equity of ________.

A) $1,600; $11,500

B) $1,600; $15,400

C) $10,200; $15,400

D) $9,500; $11,500

E) $14,500; $15,400

Correct Answer:

Verified

Q50: Global Distributors has decided to sell its

Q51: Family Travel is the sole shareholder in

Q52: The shareholders in the acquiring firm may

Q53: Studies conducted on mergers and acquisitions have

Q54: Nationwide Markets is a diversified company with

Q56: Which one of the following statements is

Q57: Davidson Global proposed splitting itself into four

Q58: The primary purpose of a flip-in provision

Q59: Which one of the following defensive tactics

Q60: If a firm sells its crown jewels

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents