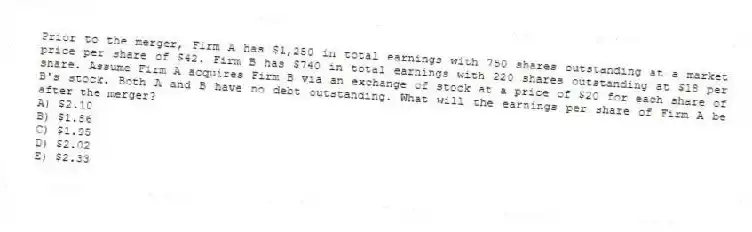

Prior to the merger, Firm A has $1,250 in total earnings with 750 shares outstanding at a market price per share of $42. Firm B has $740 in total earnings with 220 shares outstanding at $18 per share. Assume Firm A acquires Firm B via an exchange of stock at a price of $20 for each share of B's stock. Both A and B have no debt outstanding. What will the earnings per share of Firm A be after the merger?

A) $2.10

B) $1.86

C) $1.95

D) $2.02

E) $2.33

Correct Answer:

Verified

Q67: Moore Industries has agreed to be acquired

Q68: Taylor's Hardware is acquiring The Corner Store

Q69: Nadine's Home Fashions has $2.12 million in

Q70: Sue's Bakery is planning on merging with

Q71: The Cookie Shoppe and Sweet Treats are

Q73: Hanover Tires is being acquired by Better

Q74: Glendale Marine is being acquired by Inland

Q75: Rural Markets and Flo's Flowers are all-equity

Q76: Silver Enterprises has acquired All Gold Mining

Q77: News Express has 26,200 shares outstanding at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents