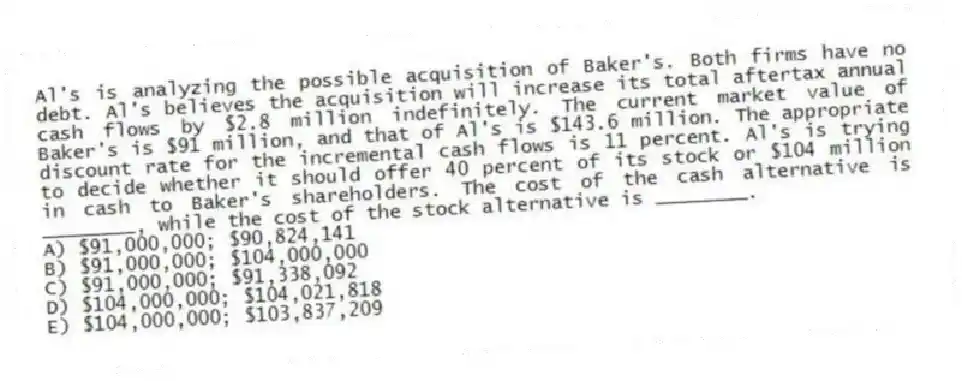

Al's is analyzing the possible acquisition of Baker's. Both firms have no debt. Al's believes the acquisition will increase its total aftertax annual cash flows by $2.8 million indefinitely. The current market value of Baker's is $91 million, and that of Al's is $143.6 million. The appropriate discount rate for the incremental cash flows is 11 percent. Al's is trying to decide whether it should offer 40 percent of its stock or $104 million in cash to Baker's shareholders. The cost of the cash alternative is ________, while the cost of the stock alternative is ________.

A) $91,000,000; $90,824,141

B) $91,000,000; $104,000,000

C) $91,000,000; $91,338,092

D) $104,000,000; $104,021,818

E) $104,000,000; $103,837,209

Correct Answer:

Verified

Q79: The Cycle Stop has 1,400 shares outstanding

Q80: Sleep Tight is acquiring Restful Inns for

Q81: Lucas Motors is considering the acquisition of

Q82: George's Equipment is planning on merging with

Q83: Firm A is being acquired by Firm

Q84: Alpha is planning on merging with Beta.

Q85: The bidding firm (Firm B) has 2,300

Q86: VC is merging with DRW. VC will

Q88: Firm B is being acquired by Firm

Q89: Mercantile Exchange is being acquired by National

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents