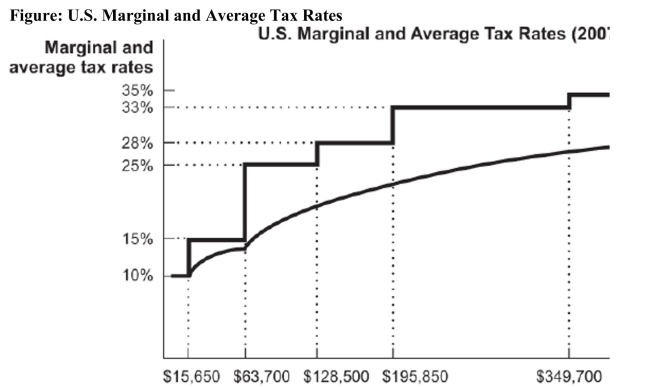

Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) According to the figure, an individual who earns $85,000 a year will pay income tax of

Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) According to the figure, an individual who earns $85,000 a year will pay income tax of

A) $7,202.50.

B) $14,097.50.

C) $5,325.

D) $21,250.

Correct Answer:

Verified

Q1: Q2: The Social Security payment system began issuing Q6: As income rises,the average tax rate for Q6: Which of the following represents a change Q8: In the United States,the marginal tax rate Q10: What is the level of per capita Q11: In 1940,Ida May Fuller received the first Q11: The largest source of revenue for the Q19: As income rises,the marginal tax rate for Q37: Which tax rate determines whether it is![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents