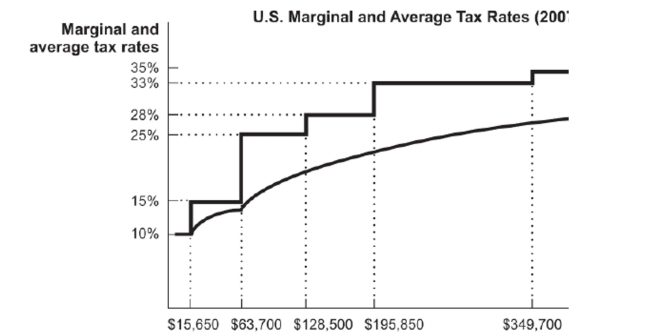

Figure: U.S. Marginal and Average Tax Rates  Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) Using the figure, assume your annual income is $15,000, that you have a deduction of $1,800 for moving expenses, and that you claim four exemptions of $3,300: one for yourself and one for each of your three children. How much taxes are you expected to pay?

Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) Using the figure, assume your annual income is $15,000, that you have a deduction of $1,800 for moving expenses, and that you claim four exemptions of $3,300: one for yourself and one for each of your three children. How much taxes are you expected to pay?

A. $132 B. $0 C. $138 D. $120

Correct Answer:

Verified

Q7: Since 1960,marginal tax rates in the United

Q11: The largest source of revenue for the

Q12: In 2010, federal government taxation made up

Q13: In 2010, federal government spending made up

Q14: The two lowest marginal tax brackets in

Q17: Figure: U.S. Marginal and Average Tax Rates

Q19: What are the three largest sources of

Q20: Income that is not subject to taxation

Q21: Suppose the tax rate on the first

Q26: The tax rate paid on an additional

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents