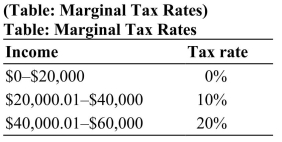

For a family earning $45,000, use the tax rates from the table and determine its marginal tax rate, average tax rate, and total income tax payment. Is this a progressive, regressive, or flat tax code? Explain.

For a family earning $45,000, use the tax rates from the table and determine its marginal tax rate, average tax rate, and total income tax payment. Is this a progressive, regressive, or flat tax code? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q133: Almost a third of the total national

Q136: Using what you know about the U.

Q141: Suppose you see the following claim made

Q142: How does the marginal tax rate compare

Q144: Economists are more concerned about the future

Q145: Social Security operates on a "pay as

Q147: Explain the difference between an average tax

Q153: Explain the difference between Medicare and Medicaid.

Q154: The debt-to-GDP ratio for the United States

Q157: All taxes on businesses,such as the payroll

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents