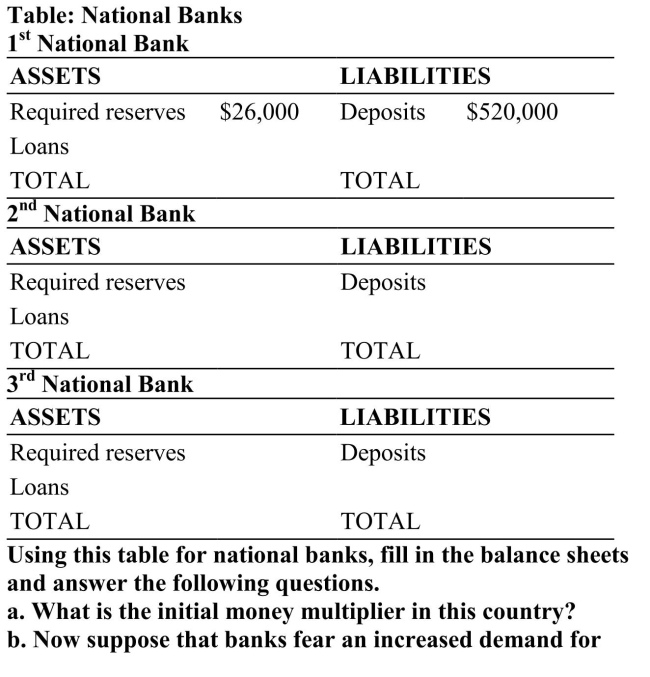

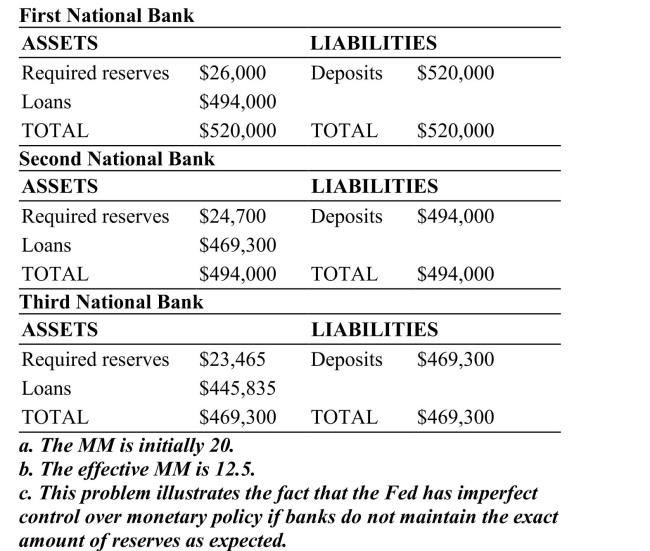

(Table: National Banks) Assume that all banks follow the same required reserve ratio requirement. Also assume that the banks are listed in sequential order (thus the loans from The First National Bank become the deposits for the Second National Bank, and the loans from the Second National Bank become the deposits for the Third National Bank, and so on). Also, the banks' balance sheets must always be balanced.  withdrawals, and thus each bank maintains 3 percent extra deposits as excess reserves over and above required reserves. What is the effective money multiplier now? c. What difficulty associated with monetary policy is illustrated by this question?

withdrawals, and thus each bank maintains 3 percent extra deposits as excess reserves over and above required reserves. What is the effective money multiplier now? c. What difficulty associated with monetary policy is illustrated by this question?

B.

Correct Answer:

Verified

Q142:

Q223: If the money multiplier is large,then action

Q224: Most of the time,a majority of banks

Q230: When the Federal Reserve makes an open

Q231: The Term Auction Facility was set up

Q234: The Fed usually focuses on the Federal

Q237: The existence of the discount window makes

Q246: Why does a one-dollar change in bank

Q252: Describe the structure of the Federal Reserve

Q264: Explain why the existence of the Federal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents