Emmett has a choice between two bonds-Bond A and Bond

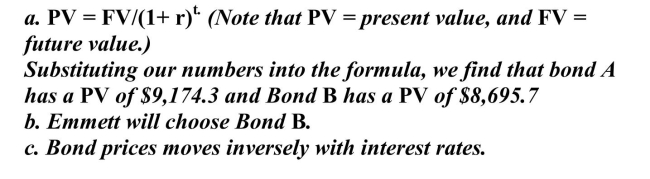

B. Both bonds have a future value of $10,000. Bond A earns 3 percent interest and Bond B earns 5 percent interest and both bonds have a term to maturity of 3 years. a. Calculate the PV (present value) of the two bonds. b. If Emmett decides to ignore the relative risk of the two bonds, and is only interested in locking up the least amount of money into the bond today, which bond will he choose? c. From this little example, what can you say about the relationship between bond prices and interest rates?

A.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: With the aid of a diagram for

Q143: Explain how an increase in government borrowing

Q144: Briefly discuss the four ways that can

Q150: The loanable funds market is currently at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents