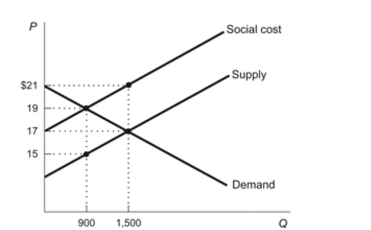

(Figure: Negative Externality) The figure shows the market for a good that causes a negative externality when consumed. The government decides to begin taxing its producers. Using the information provided in the figure, answer the following questions. Figure: Negative Externality  a. What is the market quantity in this market? b. What is the social cost of the product? c. When the product is taxed, what is the dollar amount of the deadweight loss that is removed from the market? d. What is the new efficient quantity in this market after the tax has been imposed?

a. What is the market quantity in this market? b. What is the social cost of the product? c. When the product is taxed, what is the dollar amount of the deadweight loss that is removed from the market? d. What is the new efficient quantity in this market after the tax has been imposed?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Make an argument that gun ownership creates

Q131: (Figure: Positive Externality) The figure shows the

Q132: The market for bathroom cleaners can be

Q222: Markets are always able to find solutions

Q230: External costs cause deadweight losses, whereas external

Q232: External benefits lead to inefficient market outcomes.

Q233: If the government subsidizes activities with external

Q240: While the Coase theorem is appealing, private

Q265: One advantage of regulation as a method

Q269: Using a demand and supply diagram, demonstrate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents