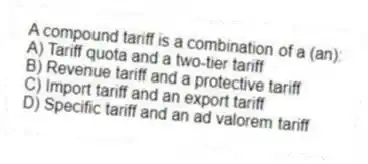

A compound tariff is a combination of a (an) :

A) Tariff quota and a two-tier tariff

B) Revenue tariff and a protective tariff

C) Import tariff and an export tariff

D) Specific tariff and an ad valorem tariff

Correct Answer:

Verified

Q40: A tax of 15 percent per imported

Q41: Table 4.1.Production Costs and Prices of Imported

Q41: Assume that the United States imports automobiles

Q42: Assume the United States is a large

Q43: Table 4.1.Production Costs and Prices of Imported

Q44: Figure 4.1 illustrates the demand and supply

Q46: Table 4.1.Production Costs and Prices of Imported

Q47: Assume the United States is a large

Q49: Table 4.1.Production Costs and Prices of Imported

Q56: If the domestic value added before an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents