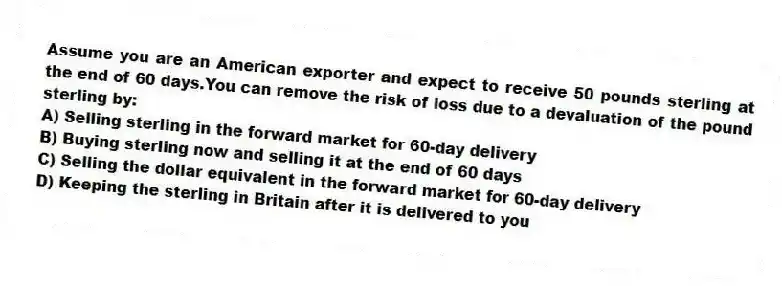

Assume you are an American exporter and expect to receive 50 pounds sterling at the end of 60 days.You can remove the risk of loss due to a devaluation of the pound sterling by:

A) Selling sterling in the forward market for 60-day delivery

B) Buying sterling now and selling it at the end of 60 days

C) Selling the dollar equivalent in the forward market for 60-day delivery

D) Keeping the sterling in Britain after it is delivered to you

Correct Answer:

Verified

Q1: If Canadian speculators believed the Swiss franc

Q2: Concerning the covering of exchange market risks--assuming

Q4: Which of the following would not induce

Q5: An appreciation in the value of the

Q6: A depreciation of the dollar refers to:

A)

Q7: If you have a commitment to pay

Q8: Over time,a depreciation in the value of

Q9: A U.S.export company scheduled to receive 1

Q10: The exchange rate is kept the same

Q11: Suppose that real incomes increase more rapidly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents