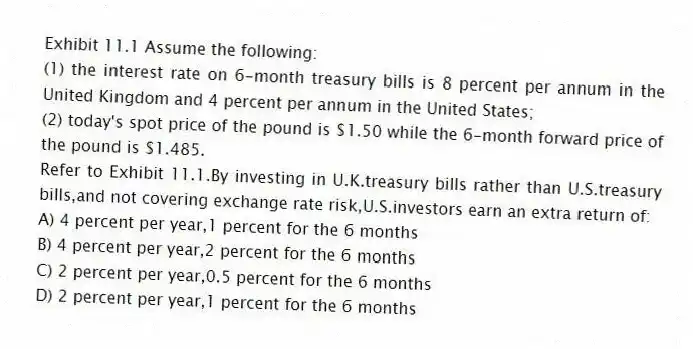

Exhibit 11.1 Assume the following:

(1) the interest rate on 6-month treasury bills is 8 percent per annum in the United Kingdom and 4 percent per annum in the United States;

(2) today's spot price of the pound is $1.50 while the 6-month forward price of the pound is $1.485.

-Refer to Exhibit 11.1.By investing in U.K.treasury bills rather than U.S.treasury bills,and not covering exchange rate risk,U.S.investors earn an extra return of:

A) 4 percent per year,1 percent for the 6 months

B) 4 percent per year,2 percent for the 6 months

C) 2 percent per year,0.5 percent for the 6 months

D) 2 percent per year,1 percent for the 6 months

Correct Answer:

Verified

Q36: Suppose the exchange value of the British

Q44: Table 11.3.Key Currency Cross Rates

Q45: A (An) _ is an arrangement by

Q46: Table 11.2.Supply and Demand of British Pounds

Q47: Exhibit 11.1 Assume the following:

(1) the

Q48: The figure below illustrates the market for

Q50: The figure below illustrates the market for

Q51: Table 11.3.Key Currency Cross Rates

Q52: Figure 11.1 illustrates the supply and demand

Q54: Table 11.4.Forward Exchange Rates

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents