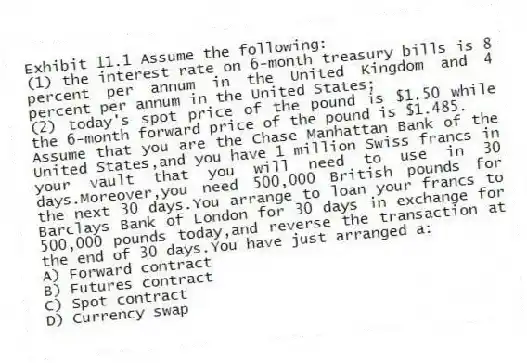

Exhibit 11.1 Assume the following:

(1) the interest rate on 6-month treasury bills is 8 percent per annum in the United Kingdom and 4 percent per annum in the United States;

(2) today's spot price of the pound is $1.50 while the 6-month forward price of the pound is $1.485.

-Assume that you are the Chase Manhattan Bank of the United States,and you have 1 million Swiss francs in your vault that you will need to use in 30 days.Moreover,you need 500,000 British pounds for the next 30 days.You arrange to loan your francs to Barclays Bank of London for 30 days in exchange for 500,000 pounds today,and reverse the transaction at the end of 30 days.You have just arranged a:

A) Forward contract

B) Futures contract

C) Spot contract

D) Currency swap

Correct Answer:

Verified

Q36: Suppose the exchange value of the British

Q42: Figure 11.1. Supply and Demand Schedules of

Q50: The figure below illustrates the market for

Q51: Table 11.3.Key Currency Cross Rates

Q52: Figure 11.1 illustrates the supply and demand

Q54: Table 11.4.Forward Exchange Rates Q56: Table 11.4.Forward Exchange Rates Q58: Exhibit 11.1 Assume the following: Q59: Figure 11.1 illustrates the supply and demand Q60: Table 11.2.Supply and Demand of British Pounds

![]()

![]()

(1) the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents