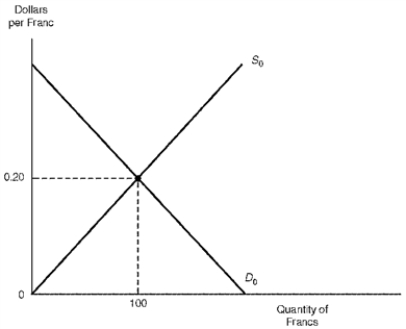

The figure below illustrates the supply and demand schedules of Swiss francs in a market of freely-floating exchange rates.

Figure 12.1 The Market for Francs

-Refer to Figure 12.1.Should real interest rates in the United States rise relative to real interest rates in Switzerland,there would occur a (an) :

A) Increase in the demand for francs--decrease in the supply of francs-depreciation of the dollar

B) Increase in the demand for francs--decrease in the supply of francs-appreciation of the dollar

C) Decrease in the demand for francs--increase in the supply of francs-appreciation of the dollar

D) Decrease in the demand for francs--decrease in the supply of francs-depreciation of the dollar

Correct Answer:

Verified

Q53: The quantity of Canadian dollars supplied to

Q54: The figure below illustrates the supply and

Q55: The figure below illustrates the supply and

Q56: Given a system of floating exchange rates,if

Q57: Assume that labor productivity growth is slower

Q59: Assume a system of floating exchange rates.Due

Q60: Given floating exchange rates,a simultaneous decrease in

Q61: Suppose that the yen-dollar exchange rate changes

Q62: Lower tariffs on U.S.agricultural imports cause the

Q63: Relatively high interest rates in the United

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents