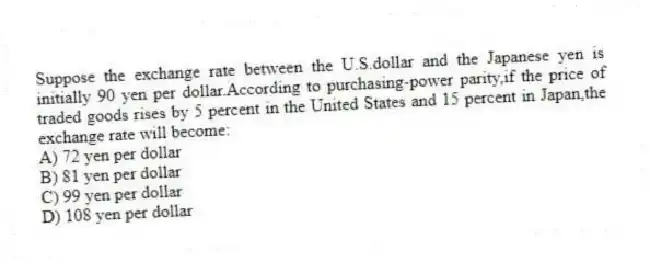

Suppose the exchange rate between the U.S.dollar and the Japanese yen is initially 90 yen per dollar.According to purchasing-power parity,if the price of traded goods rises by 5 percent in the United States and 15 percent in Japan,the exchange rate will become:

A) 72 yen per dollar

B) 81 yen per dollar

C) 99 yen per dollar

D) 108 yen per dollar

Correct Answer:

Verified

Q62: Lower tariffs on U.S.agricultural imports cause the

Q63: Relatively high interest rates in the United

Q64: When deciding between U.S.and British government securities,an

Q65: Given a floating exchange rate system an

Q66: The purchasing-power parity theory suffers from the

Q68: The asset market theory of exchange rate

Q69: Figure 12.3Market for British Pounds

Q70: Increased tariffs on U.S.steel imports cause the

Q71: Under a system of floating exchange rates,a

Q72: With floating exchange rates,relatively high productivity growth

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents