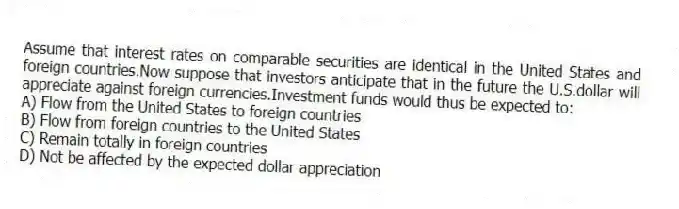

Assume that interest rates on comparable securities are identical in the United States and foreign countries.Now suppose that investors anticipate that in the future the U.S.dollar will appreciate against foreign currencies.Investment funds would thus be expected to:

A) Flow from the United States to foreign countries

B) Flow from foreign countries to the United States

C) Remain totally in foreign countries

D) Not be affected by the expected dollar appreciation

Correct Answer:

Verified

Q5: Under the gold standard,a surplus nation facing

Q6: Assume that Canada initially faces payments equilibrium

Q7: Exhibit 13.1

Assume the marginal propensity to consume

Q8: The monetary approach to balance-of-payments adjustments suggests

Q9: Assume that Canada initially faces payments equilibrium

Q11: Exhibit 13.1

Assume the marginal propensity to consume

Q12: Suppose Japan increases its imports from Sweden,leading

Q13: Which of the following does not represent

Q14: Under the gold standard,a deficit nation facing

Q15: During the gold standard era,central bankers agreed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents