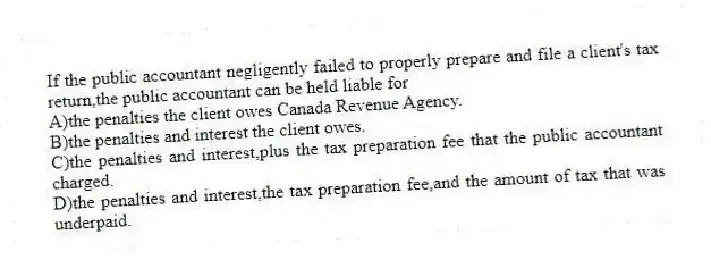

If the public accountant negligently failed to properly prepare and file a client's tax return,the public accountant can be held liable for

A) the penalties the client owes Canada Revenue Agency.

B) the penalties and interest the client owes.

C) the penalties and interest,plus the tax preparation fee that the public accountant charged.

D) the penalties and interest,the tax preparation fee,and the amount of tax that was underpaid.

Correct Answer:

Verified

Q44: To ensure that employees remain independent,an audit

Q45: At a small practice where the bulk

Q46: Why does a self-review threat pose a

Q47: Raul,PA,received a call from his friend Cristobal

Q48: Discuss the ways the accounting profession and

Q50: Each of the following situations involves a

Q51: Each of the following situations involves a

Q52: Where an independence threat occurs,it may be

Q53: An intimidation threat occurs when

A)it is difficult

Q54: Which of the following is the best

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents