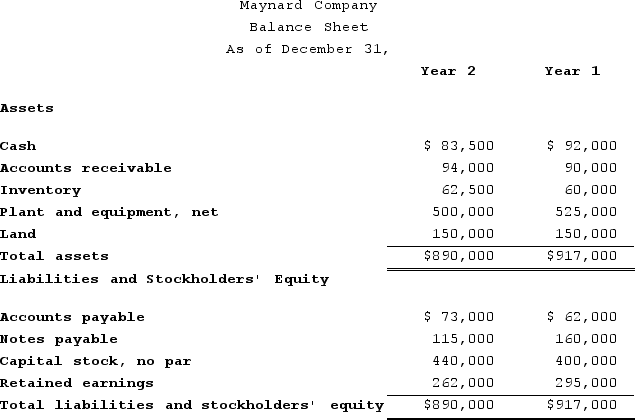

Maynard Company's balance sheet and income statement are provided below:

The company paid cash dividends of $2.00 per share during Year 2. On December 31, Year 2, the stock was listed on the stock exchange at a price of $78.25 per share.

The company paid cash dividends of $2.00 per share during Year 2. On December 31, Year 2, the stock was listed on the stock exchange at a price of $78.25 per share.

Required:

Compute the following ratios for Year 2:Accounts receivable turnoverAverage days to collect receivablesInventory turnoverAverage days to sell inventoryDebt to assets ratioDebt to equity ratioNet marginAsset turnoverReturn on investmentDividend yield

Round your answers to one decimal place.

Correct Answer:

Verified

Q162: Comparative income statements for Chicago Company

Q163: Longwood Company had a current ratio

Q164: A careless accountant splattered spaghetti sauce on

Q165: On December 31, Year 1, Houston Company's

Q166: For Year 2, Weston Corporation reported after-tax

Q167: Selected financial information for Martin Company

Q168: Comparative income statements for Pearle Company

Q169: On December 31, Year 1, Allen Company's

Q171: Select the term from the list provided

Q172: Select the term from the list provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents