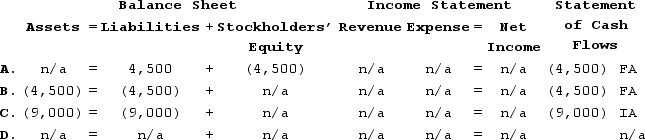

On March 1, Year 1, Gilmore Incorporated declared a cash dividend on its 1,500 outstanding shares of $50 par value, 6% preferred stock. The dividend will be paid on May 1, Year 1 to the stockholders of record as of April 1, Year 1.Which of the following reflects the financial statement effects on the May 1, Year 1 date of payment?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q66: Llewelyn Company purchased 1,000 shares of its

Q67: Curtain Company paid dividends of $7,000; $11,000;

Q68: Curtain Company paid dividends of $6,000; $12,000;

Q70: For Year 1, the Sacramento Corporation had

Q72: Which of the following is a negative

Q73: Helena Corporation declared a 2-for-1 stock

Q74: Which of the following statements about the

Q75: Kellogg, Incorporated purchased 200 shares of its

Q76: Chandler Company declared and paid a cash

Q80: Which of the following statements is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents