The Bristol-Fuller partnership was formed on January 1, Year 1, when Bristol and Fuller invested $40,000 and $30,000 cash in the partnership, respectively. During Year 1, the partnership earned $75,000 in cash revenues and paid $52,000 in cash expenses. Bristol withdrew $5,000 cash from the business during the year, and Fuller withdrew $4,000. The partnership agreement specified that net income should be allocated equally to the partners' capital accounts.Required:

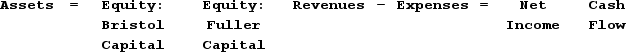

Indicate how each of the transactions and events for the Bristol partnership affects the financial statements model, below. Indicate dollar amounts of increases and decreases. For cash flows, indicate whether each is an operating activity (OA), investing activity (IA), or financing activity (FA). Indicate NA if an element is not affected by a transaction.

Correct Answer:

Verified

Q21: What is the importance of record date

Q24: Discuss a few common reasons for increases

Q26: On what date do dividends become a

Q38: In which section of the balance sheet

Q123: Show the effect of a stock dividend

Q124: The Mason-Dixon partnership was formed on January

Q128: Green Corporation has the following stock

Q129: Describe the conditions that would exist if

Q130: The Rubble-Flintstone Company was started on January

Q131: The Curtis Company was started on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents