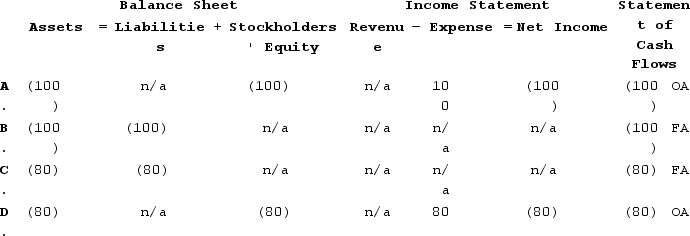

Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1, Year 1. On January 1, Year 1, the Niagara Corporation arranges a $6,000 line of credit with the Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year.Niagara records the first year's interest payment on December 31, Year 1. Centennial's prime rate is 4% for Year 1. Which of the following answers shows the effect of this event on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q18: How does the amortization of the principal

Q94: The Platte Corporation issues a 5-year note

Q95: Franklin Company obtained a $155,000 line

Q96: On January 1, Year 1, the Mahoney

Q98: Issuing bonds payable when the market rate

Q100: On January 1, Year 1, the Mahoney

Q101: Jones Company issued bonds with a $170,000

Q102: On January 1, Year 1, Pierce Corporation

Q103: The Gordon Corporation issued $70,000 of 6%,

Q104: Denver Company issued bonds with a face

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents