Baird Manufacturing Company issued $150,000 of 7%, 5-year bonds for $144,000, on January 1, Year 1. Interest is payable on January 1 of each year. Baird uses the straight-line method of amortization. The first interest payment is to be made on January 1, Year 2.

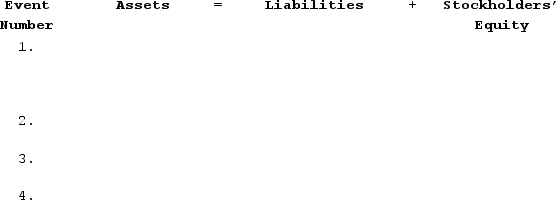

Required:Show the effects of the following events on the accounting equation.

Event 1. The issuance of the bonds.

Event 2. Accrual of interest at December 31, Year 1.

Event 3. Amortization of discount at December 31, Year 1.

Event 4. Payment of interest on January 1, Year 2.

What is the carrying value of the bond on December 31, Year 1?What is the amount of interest paid in (1) Year 1? (2) Year 2?What is the amount of interest expense shown on the income statement in Year 1?

What is the carrying value of the bond on December 31, Year 1?What is the amount of interest paid in (1) Year 1? (2) Year 2?What is the amount of interest expense shown on the income statement in Year 1?

Correct Answer:

Verified

Q198: If $200,000 of 12% bonds are issued

Q199: Zirkle Company borrowed $100,000 from Plains Bank

Q200: Describe the effect on the accounting equation

Q201: Greenwood Company issued 150 $1,000, 6% bonds

Q202: Morrison Company issued $200,000 of 10-year, 8%

Q203: San Jose Company issued five-year 8% bonds

Q204: Hanover Corporation issued $300,000 in bonds payable

Q206: Stanton Company issued five-year 7% bonds with

Q207: Maitland Corporation issued ten-year, $200,000, 8% bonds

Q208: Compute the amount of cash a company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents