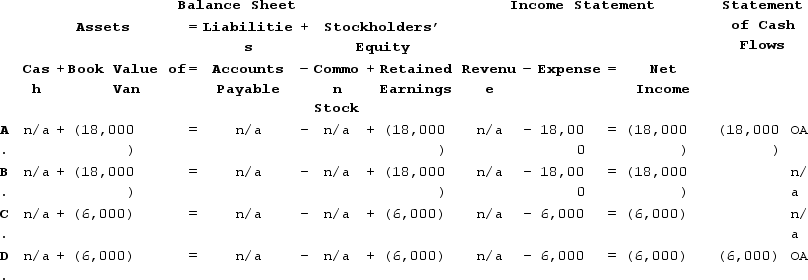

On January 1, Year 1, Mike Moving Company paid $27,000 to purchase a truck. The truck was expected to have a four-year useful life and $3,000 salvage value. If Mike uses the straight-line method, which of the following shows how the adjustment to recognize depreciation expense at the end of Year 3 will affect the Company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q28: Dinkins Company purchased a truck that cost

Q52: On March 1,Bartholomew Company purchased a new

Q59: Flagler Company purchased equipment that cost $90,000.

Q61: On January 1, Year 1, Mike Moving

Q62: Dinkins Company purchased a truck that cost

Q65: Zebra Company purchased a van for $8,000

Q66: Madison Company owned an asset that had

Q67: Jing Company was started on January 1,

Q68: On January 1, Year 1, the City

Q69: On January 1, Year 1, Friedman Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents