Geary, Incorporated had the following sales during Year 2:

Geary also had the following beginning and ending balances in its receivables accounts:

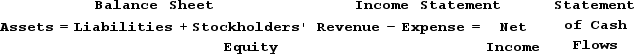

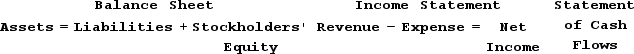

Geary, who uses the allowance method of accounting for uncollectible accounts, estimated that 3% of the credit sales will go uncollected. The credit card company charges Geary a 4% service charge.Required:How will Geary's year-end adjusting entry for uncollectible accounts expense affect the company's financial statements?

How will the entry to record the credit card sales affect the company's financial statements?

How will the entry to record the credit card sales affect the company's financial statements?

What is Geary's cash flow from customers for the year?

What is Geary's cash flow from customers for the year?

Correct Answer:

Verified

\[\begin{array} { l r }

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Curtis Company uses the FIFO cost

Q47: The Atkins Company had the following beginning

Q48: The following information is for Benitez

Q49: Curtis Company had the following transactions

Q50: The following information is for Poole

Q52: The following information is for Choi Company

Q53: Singh Company sold 75 units @

Q54: Chopin Company sells product A. The beginning

Q55: During December Year 1, Crowe Company

Q56: Jones Company sells exercise bikes. Its beginning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents