Jackson Medical Supply, which uses the perpetual inventory system, experienced the following events during June Year 1.Issued common stock for cash.Purchased inventory on account, terms 2/10, n/30, FOB shipping point.Paid the shipping charges on the purchase in event number 2.Sold merchandise to a customer on account, terms 2/10, n/30, FOB destination. Record the revenue recognition as 4(a) and the expense recognition as 4(b).Paid the shipping charges on goods sold in event number 4.Customer returned some of the merchandise sold in event number 4. Record the effect on revenue as 6(a) and the effect on expenses as 6(b).Recorded discount granted to the customer in event number 4.Recorded payment received from the customer in event number 4.Recorded discount received on purchase in event number 2.Recorded payment of amount due on purchase in event number 2.

Required:

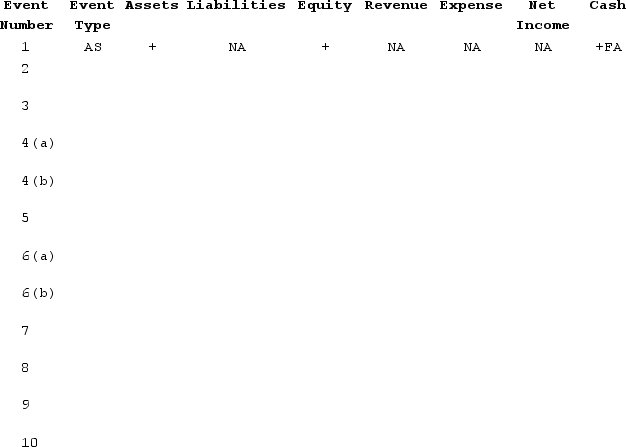

Identify each event as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also explain how each event affects the financial statements by placing a + for increase, − for decrease, or NA for not affected under each of the components of the following statements model. If the element both increases and decreases, mark with "+−". Also, indicate in the cash column if the event would be recorded as an operating activity (OA), an investing activity (IA) or a financing activity (FA). In the cash column, use + to indicate a cash inflow and − to indicate a cash outflow. The first event is recorded as an example.

Correct Answer:

Verified

Q21: Explain the difference between "transportation in" and

Q23: How do gains and losses differ from

Q29: Below are the income statements of

Q31: The following events pertain to The Craft

Q32: The income statements for the Alpha

Q33: Indicate how the determination of the amount

Q34: If a company uses the perpetual inventory

Q36: Mattress Warehouse, which uses the perpetual inventory

Q38: At the beginning of the year, Superior

Q39: Discuss the major differences between a perpetual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents