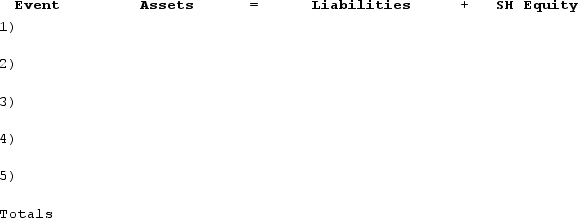

Grant Helton started a consulting business, Grant Consulting, on January 1, Year 1, and the business engaged in the following transactions during the year:Issued $40,000 of common stock for cashProvided services on account, $46,500Incurred $37,500 of operating expense, but only paid $32,000 of this amountCollected $39,000 of the revenue that was previously recorded on accountPaid a cash dividend of $4,000 to the stockholdersRequired:Show the effects of the above transactions on the accounting equation.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: In a company's annual report, the reader

Q143: Tucker Company shows the following transactions for

Q144: The effects of transactions occurring during Year

Q145: Consider the following independent scenarios:At January 1,

Q146: In a company's annual report, the reader

Q148: The following events apply to Bowman's Cleaning

Q149: Cascade Corporation began business operations and experienced

Q150: Oregon Company began operations on January 1,

Q151: The following transactions apply to Kellogg Company.Issued

Q152: Jenna Fisk started her business by issuing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents