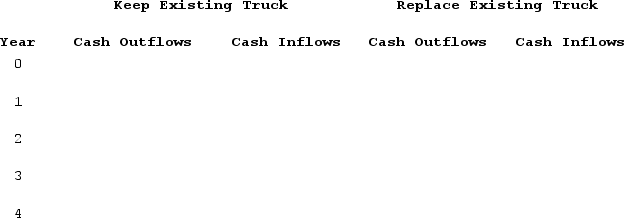

Bruce Company is considering replacing one of its delivery trucks. The truck in question was purchased two years ago at a cost of $41,000. At the time of purchase the truck was expected to have a $5,000 salvage value at the end of its six-year life. Given the use of straight-line depreciation, the truck has a current book value of $29,000. If sold today, the company could get $22,000 for the truck. It costs $20,000 per year to operate the existing truck. The new truck would cost $46,000 and would cost only $14,000 per year to operate. The new truck would be depreciated on a straight-line basis over its four-year useful life to its expected salvage value of $10,000. The company's required rate of return is 14%. Ignore income taxes. (PV of $1and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required:Identify the cash flows for each alternative by completing the following table:

Correct Answer:

Verified

Q147: Five years ago,Burton Company purchased equipment with

Q151: Omicron Company is considering purchasing equipment that

Q162: Gordon Company is considering a three-year capital

Q163: In Year 1, Chandler Company purchased

Q164: Montana Company is evaluating two different

Q165: Bristles Hair Salon is considering installing spray-tanning

Q166: Levin Company is considering two new

Q167: Janelle Bates has just inherited $250,000 from

Q170: Columbus Company is considering a project that

Q172: Select the term from the list provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents