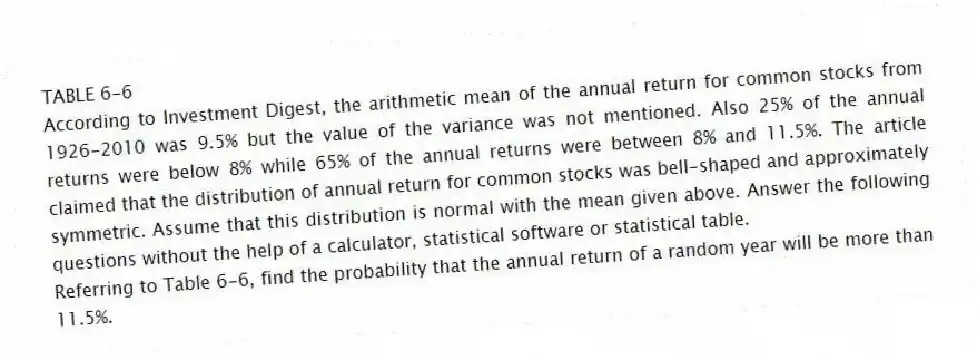

TABLE 6-6

According to Investment Digest, the arithmetic mean of the annual return for common stocks from 1926-2010 was 9.5% but the value of the variance was not mentioned. Also 25% of the annual returns were below 8% while 65% of the annual returns were between 8% and 11.5%. The article claimed that the distribution of annual return for common stocks was bell-shaped and approximately symmetric. Assume that this distribution is normal with the mean given above. Answer the following questions without the help of a calculator, statistical software or statistical table.

-Referring to Table 6-6, find the probability that the annual return of a random year will be more than 11.5%.

Correct Answer:

Verified

Q178: TABLE 6-5

A company producing orange juice buys

Q179: TABLE 6-3

Suppose the time interval between two

Q180: TABLE 6-5

A company producing orange juice buys

Q181: TABLE 6-6

According to Investment Digest, the arithmetic

Q182: TABLE 6-6

According to Investment Digest, the arithmetic

Q184: TABLE 6-6

According to Investment Digest, the arithmetic

Q185: TABLE 6-6

According to Investment Digest, the arithmetic

Q186: TABLE 6-6

According to Investment Digest, the arithmetic

Q187: TABLE 6-6

According to Investment Digest, the arithmetic

Q188: TABLE 6-6

According to Investment Digest, the arithmetic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents