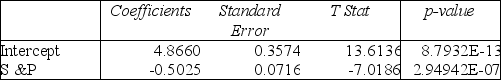

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the measured value of the test statistic is

A) -7.019.

B) -0.503.

C) 0.072.

D) 0.357.

Correct Answer:

Verified

Q87: The residuals represent

A)the difference between the actual

Q102: The sample correlation coefficient between X and

Q112: If the correlation coefficient (r) = 1.00,

Q113: The sample correlation coefficient between X and

Q114: If the correlation coefficient (r)= 1.00,then

A)all the

Q115: The sample correlation coefficient between X and

Q116: Testing for the existence of correlation is

Q119: TABLE 13-7

An investment specialist claims that if

Q121: TABLE 13-8

It is believed that GPA (grade

Q135: The width of the prediction interval for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents