TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

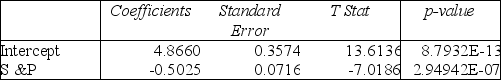

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, which of the following will be a correct conclusion?

A) You cannot reject the null hypothesis and, therefore, conclude that there is sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

B) You can reject the null hypothesis and, therefore, conclude that there is sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

C) You cannot reject the null hypothesis and, therefore, conclude that there is insufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

D) You can reject the null hypothesis and conclude that there is insufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

Correct Answer:

Verified

Q102: The sample correlation coefficient between X and

Q106: If you wanted to find out if

Q109: TABLE 13-8

It is believed that GPA (grade

Q109: The strength of the linear relationship between

Q110: What do we mean when we say

Q112: If the correlation coefficient (r) = 1.00,

Q113: The sample correlation coefficient between X and

Q115: The sample correlation coefficient between X and

Q116: Testing for the existence of correlation is

Q118: When r = - 1,it indicates a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents