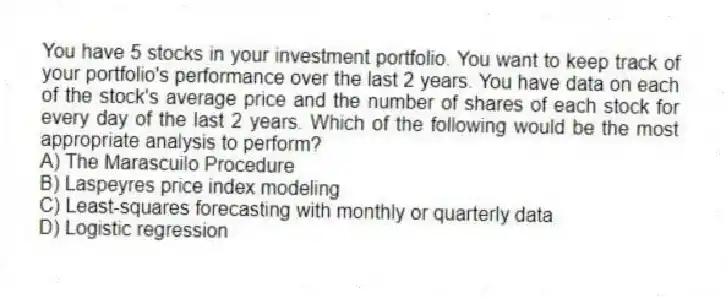

You have 5 stocks in your investment portfolio. You want to keep track of your portfolio's performance over the last 2 years. You have data on each of the stock's average price and the number of shares of each stock for every day of the last 2 years. Which of the following would be the most appropriate analysis to perform?

A) The Marascuilo Procedure

B) Laspeyres price index modeling

C) Least-squares forecasting with monthly or quarterly data

D) Logistic regression

Correct Answer:

Verified

Q2: A company that manufactures designer jeans is

Q3: A medical doctor is involved in a

Q8: A tabular presentation that shows the outcome

Q18: The difference between expected payoff under certainty

Q195: TABLE 16-2

Given below are the prices of

Q196: A buyer for a manufacturing plant suspects

Q198: TABLE 16-2

Given below are the prices of

Q201: TABLE 19-1

The following payoff table shows profits

Q202: TABLE 19-1

The following payoff table shows profits

Q204: TABLE 19-1

The following payoff table shows profits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents