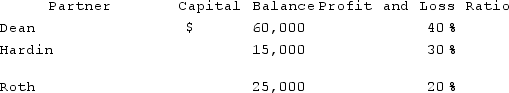

Assume the partnership of Dean, Hardin, and Roth has been in existence for a number of years.Dean decides to withdraw from the partnership when the partners' capital balances are as follows:

An appraisal of the business and its property estimates the fair value to be $ 100,000. Dean has agreed to receive $64,000 in exchange for his partnership interest.Prepare the journal entry for the payment to Dean in the dissolution of his partnership interest, assuming the bonus method is to be applied.

An appraisal of the business and its property estimates the fair value to be $ 100,000. Dean has agreed to receive $64,000 in exchange for his partnership interest.Prepare the journal entry for the payment to Dean in the dissolution of his partnership interest, assuming the bonus method is to be applied.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: A local partnership has two partners, Jim

Q64: Donald, Anne, and Todd have the following

Q65: Which of the following is a type

Q68: Norr and Caylor established a partnership on

Q68: The ABCD Partnership has the following balance

Q69: Norr and Caylor established a partnership on

Q75: On January 1, 2021, Lamb and Mona

Q76: A local partnership has two partners, Jim

Q77: Jipsom and Klark were partners with capital

Q77: The ABCD Partnership has the following balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents