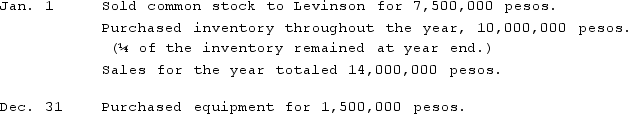

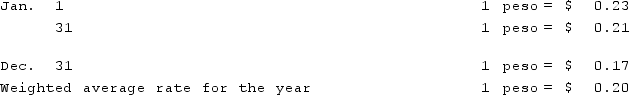

Levinson Co. established a subsidiary in Mexico on January 1, 2021. The subsidiary engaged in the following transactions during 2021:  Levinson concluded that the subsidiary's functional currency was the dollar. Exchange rates for 2021 were:

Levinson concluded that the subsidiary's functional currency was the dollar. Exchange rates for 2021 were: What amount of foreign exchange gain or loss would have been recognized in Levinson's consolidated income statement for 2021?

What amount of foreign exchange gain or loss would have been recognized in Levinson's consolidated income statement for 2021?

A) $825,000 gain.

B) $685,000 gain.

C) $270,000 loss.

D) $570,000 loss.

E) $315,000 loss.

Correct Answer:

Verified

Q7: For a foreign subsidiary that uses the

Q15: Gale Co. was formed on January 1,

Q16: Marshall Co. was formed on January 1,

Q18: Gale Co. was formed on January 1,

Q19: A U.S. company's foreign subsidiary had the

Q28: A net asset balance sheet exposure exists

Q29: Under the current rate method, retained earnings

Q32: Under the current rate method, property, plant

Q36: Under the temporal method, inventory at net

Q38: An historical exchange rate for common stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents