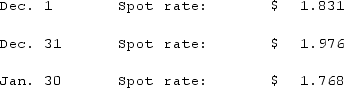

Clark Co., a U.S. corporation, sold inventory on December 1, 2021, with payment of 12,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  For what amount should Sales be credited on December 1?

For what amount should Sales be credited on December 1?

A) $18,310.

B) $19,760.

C) $23,712.

D) $21,972.

E) $21,216.

Correct Answer:

Verified

Q5: Jackson Corp. (a U.S.-based company)sold parts to

Q6: Clark Stone purchases raw material from its

Q7: A spot rate may be defined as

A)

Q8: Jackson Corp. (a U.S.-based company)sold parts to

Q9: Clark Stone purchases raw material from its

Q10: Clark Co., a U.S. corporation, sold inventory

Q11: The forward rate may be defined as

A)

Q13: A U.S. company sells merchandise to a

Q15: On June 1, Cagle Co. received a

Q20: Curtis purchased inventory on December 1, 2020.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents