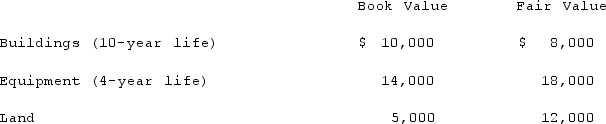

McGuire Company acquired 90 percent of Hogan Company on January 1, 2019, for $234,000 cash. This amount is reflective of Hogan's total acquisition-date fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:  Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Patent account?

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Patent account?

A) $7,000.

B) $6,300.

C) $11,000.

D) $9,900.

E) No adjustment is necessary.

Correct Answer:

Verified

Q26: In measuring the noncontrolling interest immediately following

Q32: When a parent uses the initial value

Q36: On January 1, 2019, Palk Corp. and

Q39: On January 1, 2019, Palk Corp. and

Q40: Scott Co. acquired 70% of Gregg Co.

Q42: McGuire Company acquired 90 percent of Hogan

Q43: Pell Company acquires 80% of Demers Company

Q44: McGuire Company acquired 90 percent of Hogan

Q45: McGuire Company acquired 90 percent of Hogan

Q46: McGuire Company acquired 90 percent of Hogan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents