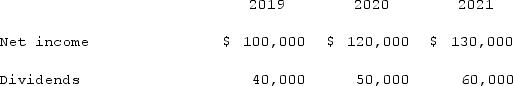

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.Demers earns income and pays dividends as follows:  Assume the partial equity method is applied.Compute the noncontrolling interest in Demers at December 31, 2021.

Assume the partial equity method is applied.Compute the noncontrolling interest in Demers at December 31, 2021.

A) $107,800.

B) $140,000.

C) $80,000.

D) $160,800.

E) $146,800.

Correct Answer:

Verified

Q80: Pell Company acquires 80% of Demers Company

Q82: Pell Company acquires 80% of Demers Company

Q84: Pell Company acquires 80% of Demers Company

Q86: Pell Company acquires 80% of Demers Company

Q87: Pell Company acquires 80% of Demers Company

Q88: Pennant Corp. owns 70% of the common

Q88: Pell Company acquires 80% of Demers Company

Q89: Pell Company acquires 80% of Demers Company

Q90: In comparing U.S.GAAP and International Financial Reporting

Q97: Parsons Company acquired 90% of Roxy Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents