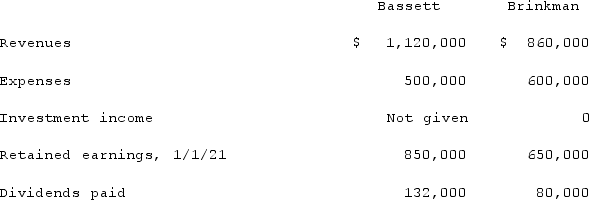

Bassett Inc. acquired all of the outstanding common stock of Brinkman Corp. on January 1, 2019, for $422,000. Equipment with a ten-year life was undervalued on Brinkman's financial records by $48,000. Brinkman also owned an unrecorded customer list with an assessed fair value of $71,000 and an estimated remaining life of five years.Brinkman earned reported net income of $185,000 in 2019 and $226,000 in 2020. Dividends of $75,000 were paid in each of these two years. Selected account balances as of December 31, 2021, for the two companies follow.  If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

A) $806,000.

B) $811,000.

C) $863,000.

D) $920,000.

E) $1,036,000.

Correct Answer:

Verified

Q33: When consolidating parent and subsidiary financial statements,

Q34: Under the equity method of accounting for

Q35: Under the initial value method, when accounting

Q35: Bassett Inc. acquired all of the outstanding

Q37: Scott Co. paid $2,800,000 to acquire all

Q43: Following are selected accounts for Green Corporation

Q44: Kaye Company acquired 100% of Fiore Company

Q44: Jackson Company acquires 100% of the stock

Q45: Kaye Company acquired 100% of Fiore Company

Q57: Kaye Company acquired 100% of Fiore Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents