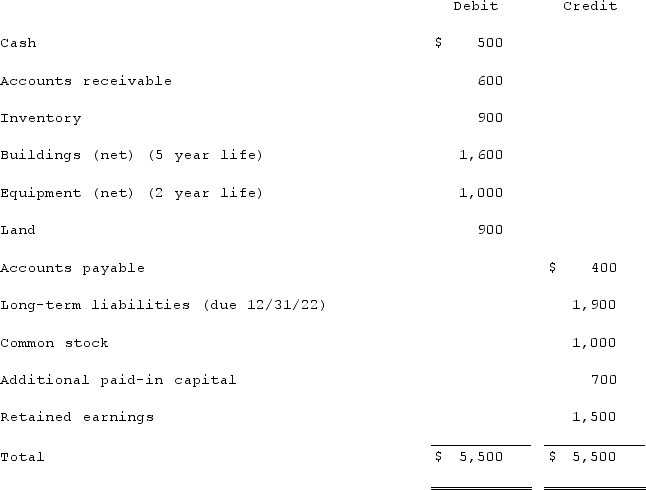

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

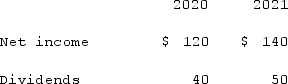

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

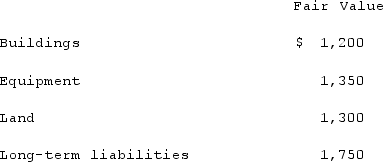

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.

A) $1,200.

B) $1,280.

C) $1,520.

D) $1,600.

E) $1,680.

Correct Answer:

Verified

Q54: Following are selected accounts for Green Corporation

Q55: Jackson Company acquires 100% of the stock

Q56: Kaye Company acquired 100% of Fiore Company

Q57: Jackson Company acquires 100% of the stock

Q58: Following are selected accounts for Green Corporation

Q60: Jackson Company acquires 100% of the stock

Q61: Beatty, Inc. acquires 100% of the voting

Q62: Following are selected accounts for Green Corporation

Q64: Following are selected accounts for Green Corporation

Q73: One company acquires another company in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents