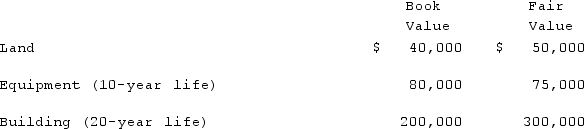

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2022?

If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2022?

A) $(5,000) .

B) $80,000.

C) $75,000.

D) $73,500.

E) $(3,500) .

Correct Answer:

Verified

Q66: How is the fair value allocation of

Q67: Anderson, Inc. acquires all of the voting

Q71: When is a goodwill impairment loss recognized?

A)

Q79: Following are selected accounts for Green Corporation

Q80: Following are selected accounts for Green Corporation

Q83: Jaynes Inc. acquired all of Aaron Co.'s

Q84: Jaynes Inc. acquired all of Aaron Co.'s

Q85: Fesler Inc. acquired all of the outstanding

Q87: Fesler Inc. acquired all of the outstanding

Q94: With respect to the recognition of goodwill

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents