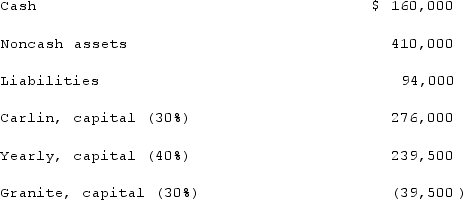

As of January 1, 2021, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses:

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.If the noncash assets are sold for $210,000, what would be the maximum amount of cash that Carlin could expect to receive?

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.If the noncash assets are sold for $210,000, what would be the maximum amount of cash that Carlin could expect to receive?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: A partnership had the following account balances:

Q46: Hardin, Sutton, and Williams have operated a

Q47: On January 1, 2021, the partners of

Q48: Hardin, Sutton, and Williams have operated a

Q49: The partners of Donald, Chief & Berry

Q50: As of January 1, 2021, the partnership

Q52: The balance sheet of Rogers, Dennis &

Q53: On January 1, 2021, the partners of

Q54: The balance sheet of Rogers, Dennis &

Q56: As of January 1, 2021, the partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents