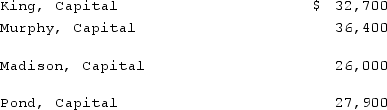

A partnership held three assets: Cash, $13,000; Land, $45,000; and a Building, $65,000. There were no recorded liabilities. The partners anticipated that expenses required to liquidate their partnership would amount to $6,000. Capital account balances were as follows:

The partners shared profits and losses 3:3:2:2, respectively.Required:Prepare a proposed schedule of liquidation, showing how cash could be safely distributed to the partners at this time.

The partners shared profits and losses 3:3:2:2, respectively.Required:Prepare a proposed schedule of liquidation, showing how cash could be safely distributed to the partners at this time.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: A partnership had the following account balances:

Q56: As of January 1, 2021, the partnership

Q57: As of January 1, 2021, the partnership

Q58: The balance sheet of Rogers, Dennis &

Q59: The balance sheet of Rogers, Dennis &

Q63: Describe the content of a journal entry

Q64: Why is a preliminary distribution of partnership

Q65: What should occur when a solvent partner

Q66: What is the purpose of a predistribution

Q72: The Arnold, Bates, Carlton, and Delbert partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents