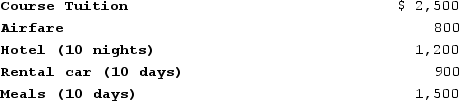

Sam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year, Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip:

What amount of travel expenditures can Sam deduct?

What amount of travel expenditures can Sam deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: Marilyn operates a day care center as

Q110: Mike operates a fishing outfitter as an

Q111: David purchased a deli shop on February

Q112: Rock Island Corporation generated taxable income (before

Q113: Sandy Bottoms Corporation generated taxable income (before

Q115: Rock Island Corporation generated taxable income (before

Q116: Sandy Bottoms Corporation generated taxable income (before

Q117: Sandy Bottoms Corporation generated taxable income (before

Q118: Mike operates a fishing outfitter as an

Q119: David purchased a deli shop on February

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents