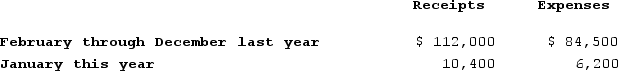

David purchased a deli shop on February 1st of last year and began to operate it as a sole proprietorship. David reports his personal taxes using the cash method over a calendar year, and he wants to use the cash method and fiscal year for his sole proprietorship. He has summarized his receipts and expenses through January 31st of this year as follows:

What income should David report from his sole proprietorship?

What income should David report from his sole proprietorship?

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q114: Sam operates a small chain of pizza

Q115: Rock Island Corporation generated taxable income (before

Q116: Sandy Bottoms Corporation generated taxable income (before

Q117: Sandy Bottoms Corporation generated taxable income (before

Q118: Mike operates a fishing outfitter as an

Q120: Sandy Bottoms Corporation generated taxable income (before

Q121: Ranger Athletic Equipment uses the accrual method

Q122: Shadow Services uses the accrual method and

Q123: Murphy uses the accrual method and reports

Q124: Bob operates a clothing business using the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents