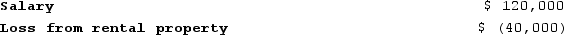

Judy, a single individual, reports the following items of income and loss:

Judy owns 100percent of the rental property and actively participates in the rental of the property. Calculate Judy's AGI.

Judy owns 100percent of the rental property and actively participates in the rental of the property. Calculate Judy's AGI.

Correct Answer:

Verified

S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: On January 1, 20X8, Jill contributed $18,000

Q84: Given that losses from passive activities can

Q85: Roy, a resident of Michigan, owns 25

Q86: Roy, a resident of Michigan, owns 25

Q87: Describe the three main loss limitations that

Q88: Judy, a single individual, reports the following

Q89: Kerri, a single taxpayer who itemizes deductions

Q91: How can electing to include preferentially taxed

Q92: Kerri, a single taxpayer who itemizes deductions

Q93: On January 1, 20X8, Jill contributed $25,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents